7.2. EARNING AND SPENDING

|

7.2.1 Introduction

|

Which expressions from the list of comments below would you use about yourself at the moment? Which are definitely not about you? |

|

He’s a multi-millionaire. She inherited millions (an oil-heiress). They won a fortune. She’s got more money than sense. They’re made of money. He’s a very wealthy businessman. She’s extremely well-off. You’re looking very prosperous. He’s comfortably off. I’m a bit hard up at the moment, actually. I’m up to my ears in debt. |

I’m down to my last ten p. He’s broke. They’re on the breadline. I haven’t got a penny to my name. I’m afraid we’re bankrupt, gentlemen. Now I know what it’s like to be poverty-stricken. I’m running into debt. I owe money everywhere. I’m heavily in debt. I’m a few thousand in the red. I wonder if it’s true that crime doesn’t pay! |

|

7.2.2 Vocabulary |

Supply the best word or words. Explain your choice. |

1. Money you are paid for your work is money you … .

a. earn b. win c. gain d. benefit

2. You want to make a phone call but only have a note. You need some … .

a. small money b. little money c. (small) change d. exchange

3. You want to know the price of something, so you say, ‘ …?’

a. How much is it b. How many is it c. How much the price d. What it costs

4. When you finish a meal at a restaurant, you ask for the … .

a. bill b. addition c. account d. reckoning

5. If you visit a doctor privately, he will certainly charge a … .

a. tariff b. fee c. tax

6. How much did you … the plumber before he left?

a. pay b. pay for

7. How much did you … that dress?

a. pay b. pay for

8. A professional person’s bill is often referred to as … .

a. a reckoning b. a tariff c. a charge d. an account

9. You might want to have a camping holiday because it is relatively … .

a. economic b. cheap

10. You want one of the oranges on display, so you ask how much they are … .

a. each b. the one c. the piece

11. When buying something by weight, you may like to know how much it is … .

a. a kilo b. per the kilo c. for the kilo

12. Someone’s selling a car and you want to know how much they’re … .

a. asking b. demanding c. charging

13. You pass an empty house and see a notice outside it which reads … .

a. To sell b. On sale c. For sale

14. Nobody likes to pay … prices.

a. high b. tall c. big . great

15. … should pay more taxes.

a. Rich b. The rich c. The riches

|

7.2.3 Reading |

Read the texts and learn the words in bold. Use them in the sentences of your own. |

Personal Finance

Sometimes in a shop they ask you: ‘How do you want to pay?’

You can answer: ‘Cash / By cheque / By credit card.’

In a bank you usually have a current account, which is one where you pay in your salary and then withdraw money to pay your everyday bills. The bank sends you a regular bank statement telling you how much money is in your account. You may also have a savings account where you deposit any extra money that you have and only take money out when you want to spend it on something special. You usually try to avoid having an overdraft or you end up paying a lot of interest. If your account is overdrawn, you can be said to be in the red (as opposed to in the black or in credit).

Sometimes the bank may lend you money – this is called a bank loan. If the bank (or building society) lends you money to buy a house, that money is called a mortgage.

When you buy (or, more formally, purchase) something in a shop, you usually pay for it outright but sometimes you buy on credit. Sometimes you may be offered a discount or a reduction on something you buy at a shop. This means that you get, say, 10 pounds off perhaps because you are a student. You are often offered a discount if you buy in bulk. It is not usual to haggle about prices in a British shop, as it is in, say, a Turkish market. If you want to return something which you have bought to a shop, you may be given a refund, i.e. your money will be returned, provided you have a receipt.

The money that you pay for services, e.g. to a school or a lawyer, is usually called a fee or fees; the money paid for a journey is a fare.

If you buy something that you feel was very good value, it’s a bargain. If you feel that it is definitely not worth what you paid for it, then you call it a rip-off (very colloquial).

Public Finance

The government collects money from citizens through taxes. Income tax is the tax collected on wages and salaries. Inheritance tax is collected on what people inherit from others.

Customs or excise duties have to be paid on goods imported from other countries. VAT or value added tax is a tax paid on most goods and services when they are bought or purchased. Companies pay corporation tax on their profits. If you pay too much tax, you should be given some money back, a tax rebate.

The government also sometimes pays out money to people in need, e.g. unemployment benefit (also known informally as the dole), disability allowances and student grants (to help pay for studying). Recipients draw a pension / unemployment benefit or are on the dole or on social security.

Every country has its own special currency. Every day the rates of exchange are published and you can discover, for example, how many dollars there are currently to the pound sterling.

A company may sell shares to members of the public who are then said to have invested in that company. They should be paid a regular dividend on their investment, depending on the profit or loss made by the company.

|

7.2.4 Practice |

A

|

Answer the following money quiz.

|

-

What currencies are used in Japan, Australia, India and Russia?

-

What does the expression ‘hard currency’ mean?

-

Name two credit cards which are usable world-wide.

-

Give two examples of imports that most countries impose customs duties on.

-

Give three examples of kinds of income that would be classed as unearned.

-

What is the Dow Jones index and what are its equivalents in London and Japan?

|

Definition

|

B

|

Match the words on the left and their definitions on the right: |

|

1. interest |

a. a bank account with minus money on it |

|

2. mortgage |

b. money paid towards the cost of raising a family |

|

3. overdrawn account |

c. money given by the government for education, welfare, etc. |

|

4. savings account |

d. an account that is used mainly for keeping money |

|

5. current account |

e. money paid to people after a certain age |

|

6. pension |

f. an account that cheques are drawn on for day-to-day use |

|

7. disability allowance |

g. money chargeable on a loan |

|

8. child benefit |

h. money paid to people with a handicap |

|

9. grant |

i. a loan to purchase property |

|

Activate |

C | Complete the sentences: |

-

Money which has to be paid on what you inherit is known as …

-

If the bank lends you money, you have a bank …

-

If you have some money in your account you are in the …

-

I paid too much tax last year so I should get a … soon.

-

If it’s no good, take it back to the shop and ask for a …

|

7.2.5 Check Yourself

|

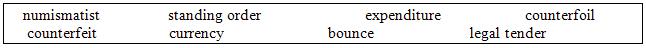

Put each of the following words or phrases in its correct place in the sentences below. Use the dictionary if necessary. |

A

-

You can change your … at any bank or large hotel.

-

She held the note up to the light to make sure it wasn’t … .

-

He collects coins and banknotes. He’s a … .

-

I always fill in the … when I write out a cheque. Otherwise I would lose track of my … .

-

I don’t trust him. I’m sure his cheque will … .

-

I pay my rent by … . It saves me having to write a cheque every month.

-

Don’t worry, Scottish banknotes are … in England too.

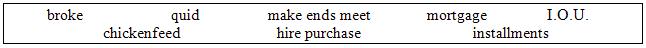

B

-

I’m afraid I have no money at all. I’m completely … .

-

She finds London very expensive. She says she can’t … on less than £100 a week.

-

To a multimillionaire £100 is … .

-

Can you lend me a couple of … ?

-

I managed to get a … to buy a house. I’ll be paying it back for the next 20 years.

-

He lent me the money but he didn’t trust me completely and asked me to give him a(n) … .

-

I couldn’t really afford the car so I got it on … and paid monthly … until it was finally mine.

|

7.2.6 Interaction |

A

|

Discuss the issues and fill in the table below for your own and one more country. |

Rate of inflation _________________________________

Exchange rate (against the US dollar) ________________

Interest rate _____________________________________

Basic level of income tax __________________________

Rate of VAT ____________________________________

Monthly state pension ___________________________

|

Opinion

|

B

|

Is the ordinary ‘person-in-the-street’ pleased to see these newspaper headlines? Why / Why not? Explain your answer. |

|

Mortgage rate goes up |

WAGES TO BE FROZEN |

Pension age raised |

|

VAT to be reduced |

Interest rates down |

number on dole rises |

|

7.2.7 Reading

|

A

|

Below is an English family’s budget in pounds sterling for next month. Look at it to see where their money is coming from and how much is going out. Note down any differences between this budget and a family budget in our country. |

Look, everyone, I think we ought to try and economize a bit this month – go carefully on our spending money, cut out a few luxuries, just generally cut down a bit. OK?

| Income | Outgoings | ||

| Basic salary (gross 380, after tax): | 335.00 | National Insurance Contributions: | 46.00 |

| Overtime payment: | 56.50 | Mortgage payment: | 175.00 |

| Productivity bonus: | 10.00 | Rates (Direct Debit) | 39.50 |

| Royalties on ‘Son of Jaws’ | 35.50 | Gas and Electricity – quarterly bills | 164.00 |

| Son’s wages (4 x 45 net) | 180.00 | Alimony – maintenance money to |

|

| His tips and commission: | 25.00 | ex-wife: | 173.50 |

| HP installment on car: | 88.00 | ||

| Basic Earnings: | 642.00 | Road Tax: | 80.00 |

| Speeding fine: | 35.00 | ||

| plus extras: | Life Insurance Premium: | 48.00 | |

| Jim’s college grant | Deposit on new washing-machine: | 45.00 | |

| (240 – 3, tax-free) | 80.00 | Accountant’s fees | |

| Freda’s scholarship (120 – 3) | 40.00 | (3 months overdue): | 25.00 |

| Child Benefit (7.50 x 2 x 4) | 60.00 | Repayment on Credit Company loan | |

| Dad’s pension: | 136.00 | (Standing Order): | 60.00 |

| Ted’s dole money – unemployment | Interest on overdraft on current | ||

| benefit: | 146.00 | account: | 45.00 |

| Dad’s dividend on his BP shares: | 13.00 | Other bank charges: | 10.00 |

| Interest on Mum’s savings (bank | Subscription to magazines: | 10.00 | |

| deposit account): | 3.50 | Donation to ‘Help the Aged’: | 5.00 |

| Tax Rebate: | 4.50 | Contribution to Labour Party funds: | 7.50 |

| Winnings on the Derby: | 2.50 | Jenny and Jim’s pocket money: | 60.00 |

| Stake money for football pools and | |||

| Total extras: | 485.50 | horse-racing: | 18.50 |

| Church Collection: | 1.00 | ||

| Total Income (all sources): | 1127.50 | Total Expenditure: 1136.00 | |

| Balance: £- 8.50 | |||

|

Practice

|

B

|

Act out a conversation between various members of this family, discussing how perhaps they could cut down and save a little money. |

|

7.2.8 Speaking

|

A

|

Note down which ways of saving and making money you thinkare sensible and which you would not recommend. |

- buying in bulk to beat inflation

- looking out for genuine reductions and real bargains in the sales

- buying supermarket brands rather than brand-name products

- buying economy-size packets and tins of things

- collecting packet tops that offer discounts on the next purchase, have ‘5p off’ labels on them or contain forms for special offers

- looking out for special HP (high-purchase) deals at good rates of interest

- delaying payment of bills until the final demand

- taking your holidays out of season at cheap rates

- buying second-hand clothes in jumble sales or charity shops

- buying products that offer trading stamps or gift vouchers or competitions with once-in-a-lifetime prizes

- using the telephone at off-peak, cheap-rate times

- shopping only at places where money can be refunded rather than goods exchanged

- changing your foreign currency when the rates of exchange are favourable

- checking your bank statement and cheque counterfoils to make sure there are no errors

- looking after receipts and guarantees

|

Discussion

|

B

|

What proportion of your income do you allocate to the following? Give a rough percentage, e.g. 0%, 5%, 15% or 25+%. |

|

|

% |

|

% |

|

% |

|

Books |

|

Gambling |

|

Music + videos |

|

|

Car / travel expenses |

|

Hairdressers, beautician, etc. |

|

Rent / mortgage |

|

|

Care / support for family members |

|

Holidays |

|

Savings |

|

|

Cinema and concerts |

|

Household bills |

|

Services of other people (cleaners, gardeners, etc.) |

|

|

Clothes |

|

Insurance |

|

Sport + fitness |

|

|

Food + drinks |

|

Medical service |

|

Other purposes (specify) |

|

-

What things would you like to spend more / less on?

-

What’s the most expensive thing you’ve bought recently?

-

What thing do you most regret having bought?

-

Are you saving up to buy anything in particular?

-

How have your spending habits changed over the last three years?

-

Is talking about money a taboo subject in our society / in your family / in the company of your friends?

|

7.2.9 Opinion |

A

|

What would you do for the right price and assuming that you really needed the money? |

-

Disclose confidential company secrets.

-

Testify falsely in court while under oath.

-

Try out a drug being experimented by a pharmaceutical company.

-

Donate unnecessary parts of your body to an unknown person.

-

Kill someone you’d never met and who you were convinced was dangerous.

|

7.2.9 Opinion |

B

|

Would you try and bribe someone for money in any of the following circumstances? |

-

The waiter to get you and your wonderful new partner the best table in the restaurant.

-

Your teacher to let you see an examination paper in advance.

-

The tax inspector so that you don’t have to pay huge amounts of taxes.

-

A personnel manager to give you a job.

-

The police to avoid a speeding fine.

|

7.2.10 Translation

|

Read and translate the following extract from a fiction book. Do you often go to the bank? What for? What impression did the bank make on you on your first visit? |

As a little boy, Hugh had thought Pilasters Bank was owned by the walkers. These personages were in fact lowly messengers but they were all rather portly, and wore immaculate morning dress with silver watch-chains across their ample waistcoats, and they moved about the bank with such ponderous dignity that to a child they appeared the most important people there.

Hugh had been brought here at the age of ten by his grandfather. The marble-walled banking hall on the ground floor had seemed like a church: huge, silent and mysterious. The mystery had gone out of it now. He knew that the massive leather-bound ledgers were not arcane texts but simple lists of financial transactions. A bill of exchange was no longer a magic spell but merely a promise to pay money at a future date, written on a piece of paper and guaranteed by a bank. Discounting, which as a child he had thought must mean counting backwards, turned out to be the practice of buying bills of exchange at a little less than their face value, keeping them until their due date, then cashing them at a small profit.

Hugh was an assistant to Jonas Mulberry, the principal clerk. A bald man of about forty, Mulberry was good-hearted but a little sour. He would always take time to explain things to Hugh, but he was quick to find fault if Hugh was in the least careless. This morning he had asked Hugh to count the applications for the Russian Loan issue. The bank was raising a loan of two million pounds for the government of Russia. It had issued one-hundred-pound bonds, which paid five pounds interest per year; but they were selling the bonds for ninety-three pounds, so the true interest rate was over five and three-eighth. Most of the bonds had been bought by other banks, but some had been offered to the public, and now the applications had to be counted.

The work took most of the day. It was a few minutes before four o’clock when Hugh added the last column of figures. A little more than one hundred thousand pounds’ worth of bonds remained unsold. It was not a big shortfall, as a proportion of a two-million-pound issue, but the bank would have to buy the surplus at ninety-three pounds. On the open market the price might go down, and the bank would have made a loss. There was a big psychological difference between oversubscribed and undersubscribed, and the partners would be disappointed.

He wrote the tally on a clean sheet of paper and went in search of Mulberry. The banking hall was quiet now. A few customers stood at the long polished counter. Pilasters was a merchant bank, lending money to traders to finance their ventures. But all the family kept accounts at the bank, and the facility was extended to a small number of very rich clients.

|

7.2.11 |

Act out either: |

|

Interaction

|

- an interview between an employer and an employee who is trying to explain how difficult it is to make ends meet on his / her salary and is therefore asking for a rise; |

|

or: |

|

|

- a conversation with your bank manager enquiring about your overdraft. Explain why you have one and what you’re going to do about it. |

|

7.2.12 Writing

|

Write the first paragraph or two of a brochure announcing that you have set up as a financial advisor. Outline the services you will be offering, the benefits that clients will receive, etc. |